The full extent of a business loan’s expense is essential for proper growth, stabilization, and expansion of your company. Almost every business loan online comes with a hidden charge.

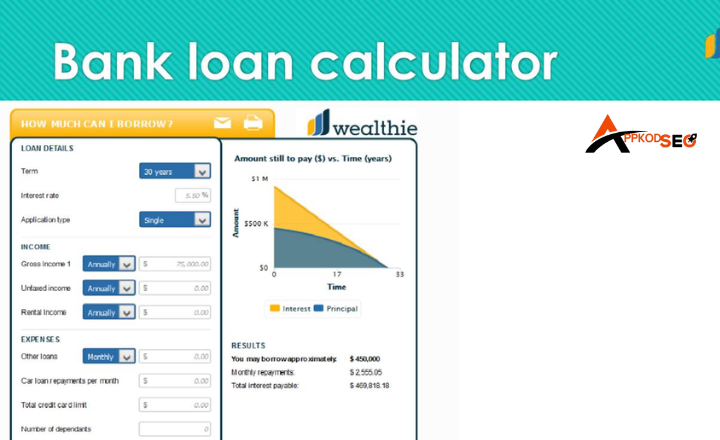

If the loan’s interest rate, repayment period, and loan amount are provided, most business loan calculators can figure out the interest and the charges. This is a helpful way for a small business or a growing enterprise to plan their finances without any ambiguity.

Why Do We Use Business Loan Calculator?

When taking a loan, approval isn’t all that is required as much as comfortably repaying the loan without affecting the activities of the business. By using a loan calculator, you get most of the information you need straightaway. You will know exactly what you’ll have to pay in any given month and how that fits into your financial plan.

Popular banks like SBI and HDFC have their own tools too, like the business loan EMI calculator SBI or HDFC business loan EMI calculator SBI.

How Do I Use It?

Typically the calculator will inquire on the:

Loan amount you are requesting for

- Interest rate (flat or reducing)

- Loan tenure (months or years)

Based on these, it automatically calculates your EMI (Equated Monthly Installment), total interest payable and the final repayment amount.

For example, if you are taking $50,000 for 3 years with a 10% interest rate, the business loan EMI calculator would tell you your monthly EMI and total repayment– all instantly at once.

Choosing the Best Calculator for Your Situation

Different kinds of calculators for business loan planning will be based on what one plans to do with it. Here are clues to know which one fits you best.

EMI Calculator for Business Loan

Businessmen most often need EMI calculation in order to properly plan monthly payments. This calculates EMI on the basis of the amount of a loan, lending term, and interest rate.

By being more specific with their requests, people often look for business loan EMI calculator HDFC or business loan EMI calculator SBI that will be in line with their bank’s conditions.

Business Loan Repayment Calculator

Should one only be interested in EMI or look at total cost, here is the calculator to plugged-in. You will learn the interest amount to be paid and see how the equilibrium will diminish over a period.

It is perfect for you in case you are planning to send additional payments or simply interested in how long it will take you to get rid of the debt.

Business Loan Interest Rate Calculator

Sometimes you may be aware of what the EMI is for you, you do not know what rate of interest is being applied. This is great to get quick results. Comparatively, the most used fora in the world with billions of pdf files loaded is a great example.

This is why an individual is bound to find loads of information as one type of business loan interest rate calculator SBI. The particular nature of your business may also have you find that you do not prefer the monthly EMI system.

Business Loan Payment Calculator

This is where the business loan payment calculator comes in handy in that you get to be able to visualize your loan via the one-off payment lump sum. It comes in handy during lump sum or flexible payment loan application whereby your obligations can be very complicated

Business Loan Calculators by Country

A business loan repayment calculator might be useful. In that case, with the assistance of a business loan amortization calculator you can get a payment method-based amortization table with the monthly repayment, interest payment, principal amount, principal payment, ending loan value, number of payments made, amount paid to date, etc.

Business Loan Calculator Pakistan

Pakistan’s loans calculators often display choices from banks such as HBL, Meezan Bank, and UBL, along with models for Islamic financing. The purpose of these calculators is to help local small and medium enterprises make sense of their loan obligations under SBP refinance schemes as well as start-up funding programs.

Loan Calculator UK

Calculators in the UK highlight loan choices from NatWest, HSBC, and Barclays among others. There are often government-backed schemes and flexible repayment models, especially post-Brexit.

Loan Calculator Canada

In Canada, calculators exist that assist in finding an estimate of the amount to be paid in a BDC loan repayment, and also assessing other private loan alternatives. Some of the calculators provide for GST and seasonal repayments.

Loan Calculator Australia

In Australia, businesses are provided with tools that enable them to compare NAB, ANZ, and CommBank loans among others. Again, these tools will help in planning by taking into account things such as small business grants and tax benefits.

Loan Calculator SBA (USA)

These tools in the U.S provide a quick and easy method for getting estimates of monthly payments for an SBA 7(a), 504 or Microloan. These tools are called Microloan calculators. These are the most popular calculators.

Loan Calculator NZ (New Zealand)

Here in New Zealand, there are calculators that will help you in the cases of Short term financing, equipment financing, and Agriculture loans so that you can do easy repayment projections.

Business Loan Eligibility Calculator

The business loan eligibility calculator checks your revenue, credit score, loan history, and existing liabilities to confirm whether you are actually eligible even as you prepare to apply. This method also saves time as you can avoid applying with lenders if you do not meet their criteria.

Business Interest Loan Calculator

You’d like to gauge your interest burden instead of being bothered about the EMI of a loan business interest. Loan calculator helps draw a line that provides better financial control to business’s interest you pay, basing on various loan amounts and loan durations.

How to Use a Loan Calculator Effectively For Your Business

Choose the right type of calculator related to your need EMI, interest rate, repayment, or eligibility. Just enter your loan amount, the rate of interest suited to the repayment term. This could be a bad time to apply. There are bad lenders online and offline, and you never apply to them.

You can also conduct a reverse rate check with other lenders. Banks like SBI and HDFC offer them, as do third-party portals such as BankBazaar, NerdWallet, and many others, to name a few.

So that you can anticipate more desirable rate weathers, you can test the calculator with peak ceilings and floors. This allows maintaining the readiness of accepting if ever your loan offer isn’t perfect.

Where to Find the Best Loan Calculators For Business

The following examples will provide you with the assistance you need.

You can find calculators that you can rely on through banks’ websites of major banks such as:

(i) The State Bank of India

(ii) HDFC Bank

(iii) The National Bank of Pakistan

(iv) Barclays UK

(v) BDC Canada

(vi) NAB Australia

(vii) SBA.gov (USA)

You can also find several fintech applications and financial portals that provide the most current tools which can be accessed on the LendingKart, Fundera. Also, use the websites specific to your country that have government startup websites.

Conclusion

In the current era of dynamic business operations, accessing the correct financial resources is paramount. Regardless of location be it the United States, Pakistan, or any other place business loan calculators provide essential insight for smart borrowing.

This tool not only assists in managing a car loan, but also guides users through the process of obtaining an SBA loan, thereby empowering users to make prudent financial choices.